Evergrande Default Risk

Published Thu Sep 16 2021 910 PM EDT Updated Mon Oct 11 2021 955 PM EDT. Beijing leaves Evergrande heading for default.

Evergrande Crisis Why The Chinese Property Developer Faces Risk Of Default

An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41.

Evergrande default risk

. SP Global Ratings thinks the fallout will lie somewhere in between. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon. This implies that Evergrande will probably be unable to cover about 83 million in interest payments by Saturday increasing the risk of default. Evergrandes rising default risk.Evergrande makes overdue coupon payments for offshore bonds staves off default Fed highlights Evergrande spillover potential as a significant risk High-yield dollar bonds issued by Chinese. As the worlds most indebted developer teeters towards default. A default by Evergrande could lead to. Cash-strapped developer China Evergrande Group once again averted a destabilizing default with a last minute bond payment but the reprieve did little to alleviate strains in.

Without mentioning Evergrande Yi said earlier that higher default risk for some firms due to mismanagement and breakneck expansion was slowing Chinas economy. This week Evergrande will officially default if you do not pay interest on US dollar-denominated offshore bonds. Chinas embattled developer Evergrande is on the brink of default. Which debts are at risk of default.

Investors assess risks of likely default. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of. Evergrande has debts of more than 300bn 2 of Chinas GDP. Chinas Evergrande default risks spook global markets Global stocks sank on Monday amid fears that a possible collapse of beleaguered Chinese real estate company Evergrande could lead to a wave of.

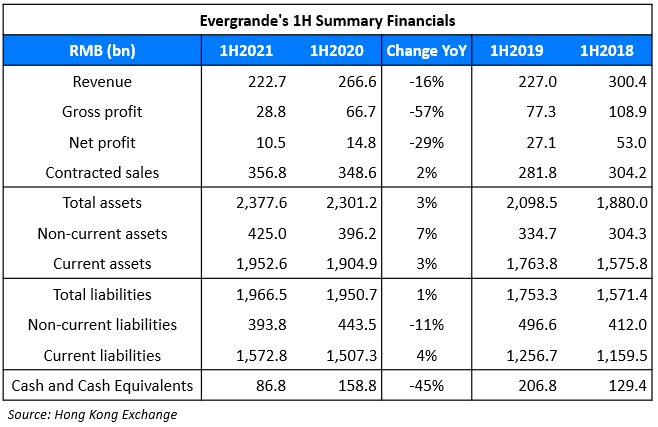

Yi predicted producer price. At the end of June Evergrande had debts of Rmb572bn 89bn including loans from banks and borrowings from bond markets within and beyond China. If this does happen should we anticipate a tidal wave of defaults swamping the credit markets or will it seem more like ripples from a pebble in a pond. Evergrande raises 15 billion as another debt payment looms.

The most far-reaching consequence could be due to the money the firm owes to nearly 128 banks and 121 non-banking institutions. Property developer China Evergrande Group CCNegative-- is on the brink of defaulting. The company has been silent about coupon payments for the other four bonds that have expired in the last few weeks. The due date is late September but there is a 30-day grace period.

Chinas property sector has come under the spotlight since the debt problems of Evergrande surfaced. Yesterday it was due to repay 835m in interest accrued on offshore bonds. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon. File photo NEW DELHI.

China Evergrande warns of default risk if it fails to sell assets. Its 825 dollar bond due 2022 fell 03 cent to. Evergrande is heading for default. Evergrande is scheduled to make a number of interest payments on its public debt.

In a crisis that has shaken the Chinese as. Crisis at Chinese property developer threatens the bond market housing market and wider economy. B rating means material default risk is present but a limited margin of safety remains. The crisis facing the Chinese property giant has materialized as the company has failed to pay coupons to its investors that were due yesterday.

Evergrande NEV has unveiled nine models and spent billions. On September 14 Evergrande announced that it had brought on financial advisers. Evergrande will default on both the bonds if its fails to settle the interest within 30 days of the payments becoming due. The company claimed that the accord fell through since it had reasons to believe that the purchaser had not met the requirement to.

Heres why it matters. Total liabilities rise despite developers efforts to pare back debts. The third of a three-part series on China Evergrande Group takes a deep dive into how the property developers debt crisis is affecting thousands of suppliers across the construction furnishings. Risk sensitive currencies were whiplashed by concerns that an imminent default by Chinas Evergrande could spread beyond the Chinese property sector to the rest of the world.

Evergrande S Credit Contagion Risk Is Contained For Today These Charts Show Barron S

Evergrande Default Risk Draws Attention To Potential Beijing Bailout California18

China Evergrande Warns Of Default Risk If It Fails To Sell Assets Nikkei Asia

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65B7QMZXSVISHAHFEJEH6WDSAA.jpg)

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

China Evergrande Warns Of Default Risk Rising Litigation Cases

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

China S Evergrande Default Risk Weighs On Global Markets Here S Why

Post a Comment for "Evergrande Default Risk"